Every little thing You Need to Learn About Equity Loan

Every little thing You Need to Learn About Equity Loan

Blog Article

Exploring the Advantages of an Equity Lending for Your Monetary Goals

Among the variety of financial tools readily available, equity lendings stand out for their potential advantages in helping people to reach their economic objectives. The benefits that equity lendings offer, varying from adaptability in fund usage to prospective tax benefits, provide a compelling situation for factor to consider.

Versatility in Fund Usage

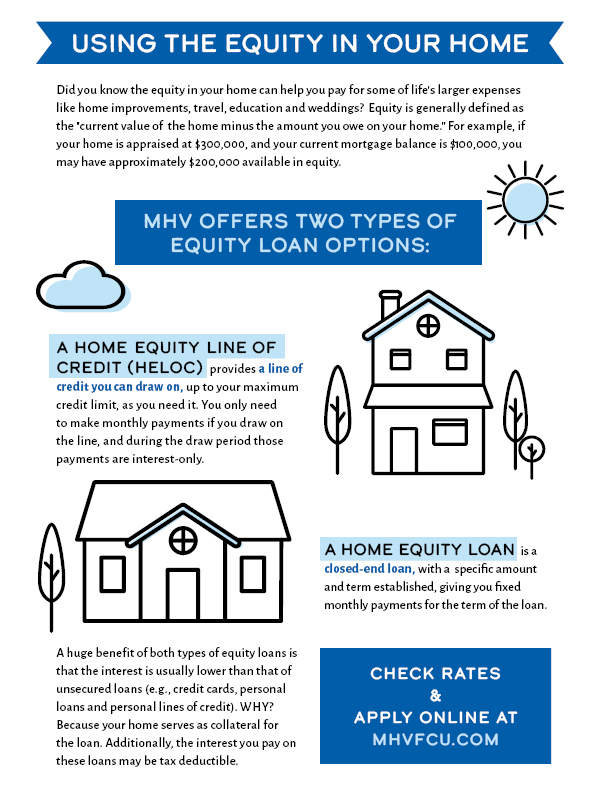

Versatility in using funds is an essential advantage associated with equity finances, giving consumers with functional choices for managing their financial resources effectively. Equity car loans permit individuals to access a line of credit based on the equity they have built up in their homes.

Furthermore, the flexibility in fund use reaches the quantity obtained, as customers can usually access a large sum of cash depending upon the equity they have in their building. This can be especially beneficial for individuals aiming to fund significant expenses or jobs without resorting to high-interest choices. By leveraging the equity in their homes, debtors can access the funds they need while benefiting from possibly lower rates of interest compared to various other forms of loaning.

Possibly Lower Interest Prices

When considering equity loans, one might find that they supply the potential for reduced rate of interest prices contrasted to alternative borrowing alternatives, making them an attractive financial choice for several individuals. This benefit comes from the fact that equity finances are safeguarded by the customer's home equity, which lowers the threat for loan providers. Due to this reduced level of threat, loan providers are usually going to supply lower rate of interest on equity car loans than on unsecured financings, such as individual car loans or charge card.

Reduced rate of interest can cause significant expense savings over the life of the loan. By protecting a reduced rate of interest via an equity car loan, debtors can possibly reduce their general passion expenditures and lower their regular monthly repayments. This can release up funds for various other economic goals or costs, eventually improving the debtor's economic position over time.

Access to Larger Funding Amounts

Offered the possibility for reduced rate of interest with equity car loans because of their secured nature, customers might also benefit from access to larger car loan quantities based upon their readily available home equity. This access to larger financing quantities can be useful for people wanting to fund considerable monetary goals or projects (Equity Loans). Whether it's for home remodellings, financial obligation loan consolidation, education and learning costs, or other considerable investments, the capability to borrow more money through an equity loan provides consumers with the economic adaptability needed to accomplish their objectives

Potential Tax Advantages

Protecting an equity car loan might offer potential tax benefits for borrowers looking for to optimize their economic benefits. One significant benefit is the possible tax deductibility of the interest paid on the equity car loan. In many instances, the rate of interest on an equity car loan can be tax-deductible, similar to home mortgage rate of recommended you read interest, under certain problems. This tax reduction can lead to reduced overall loaning expenses, making an equity lending an extra economically attractive alternative for those eligible to assert this benefit.

Additionally, using an equity lending for home renovations may additionally have tax advantages. By using the funds to refurbish or improve a main or second house, property owners might increase the residential property's value. This can be helpful when it comes time to market the home, possibly reducing funding gains tax obligations and even receiving particular exclusion limits.

It is important for consumers to talk to a tax obligation specialist to fully understand the certain tax implications and benefits connected to equity fundings in their specific circumstances. Alpine Credits copyright.

Faster Authorization Process

Final Thought

In summary, an equity lending provides flexibility in fund usage, possibly reduced interest prices, access to larger car loan amounts, possible tax advantages, and a faster approval procedure. These advantages make equity lendings a sensible option for people aiming to achieve their financial objectives (Alpine Credits Home Equity Loans). It is essential to thoroughly think about the conditions of an equity finance prior to choosing to ensure it straightens with your specific financial requirements and purposes

Provided the capacity for reduced interest prices with equity lendings due to their safeguarded nature, customers might additionally benefit from accessibility to larger lending amounts based on their offered home equity (Home Equity Loans). In comparison, equity loans, leveraging the equity in your home, can offer a quicker authorization procedure since the equity offers as collateral, lowering the danger for lending institutions. By choosing an equity car loan, debtors can accelerate the finance approval procedure and access the funds they require without delay, giving a useful financial option throughout times of urgency

Report this page